In a world increasingly interconnected through technology, purchasing gadgets from international markets has become commonplace. Yet, dealing with hidden fees, unpredictable exchange rates, and payment hassles can quickly dampen the excitement of buying new tech abroad. That’s where YouTrip comes in—a revolutionary multi-currency prepaid card designed specifically to simplify and streamline overseas purchases, making it a game changer for tech-savvy travelers.

At Esmond Service Centre, we're not just experts in gadget repairs and tech guidance; we understand the complete tech consumer journey—including hassle-free international transactions. Drawing from extensive experience assisting tech enthusiasts and frequent travelers, we’re providing this comprehensive review to clarify why YouTrip could significantly enhance your overseas shopping experience.

For gadget enthusiasts, getting the latest tech often means tapping into global markets, where pricing and availability are better. Traditional payment methods often add hidden fees and unfavorable currency exchange rates. YouTrip addresses these problems directly.

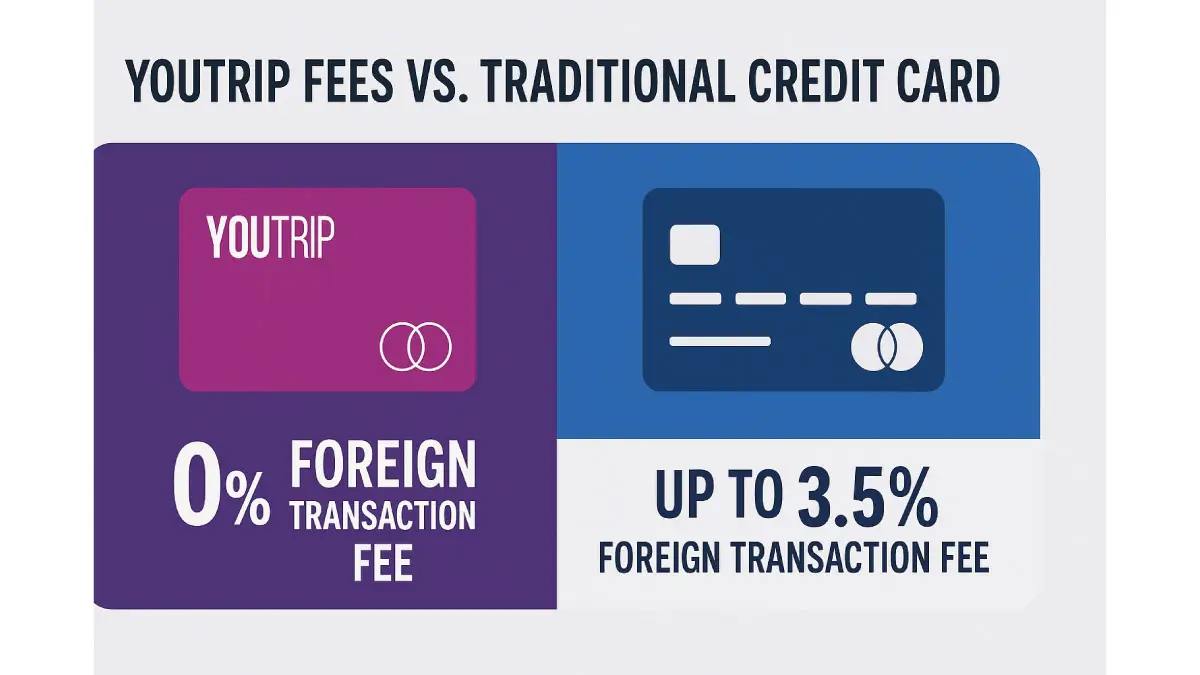

Zero Overseas Transaction Fees: Traditional cards often charge between 2-4% extra. YouTrip eliminates this, significantly reducing the cost of international tech purchases.

Real-Time Currency Conversion: With YouTrip, you always know the exact rate at the moment of purchase—no guessing or surprises.

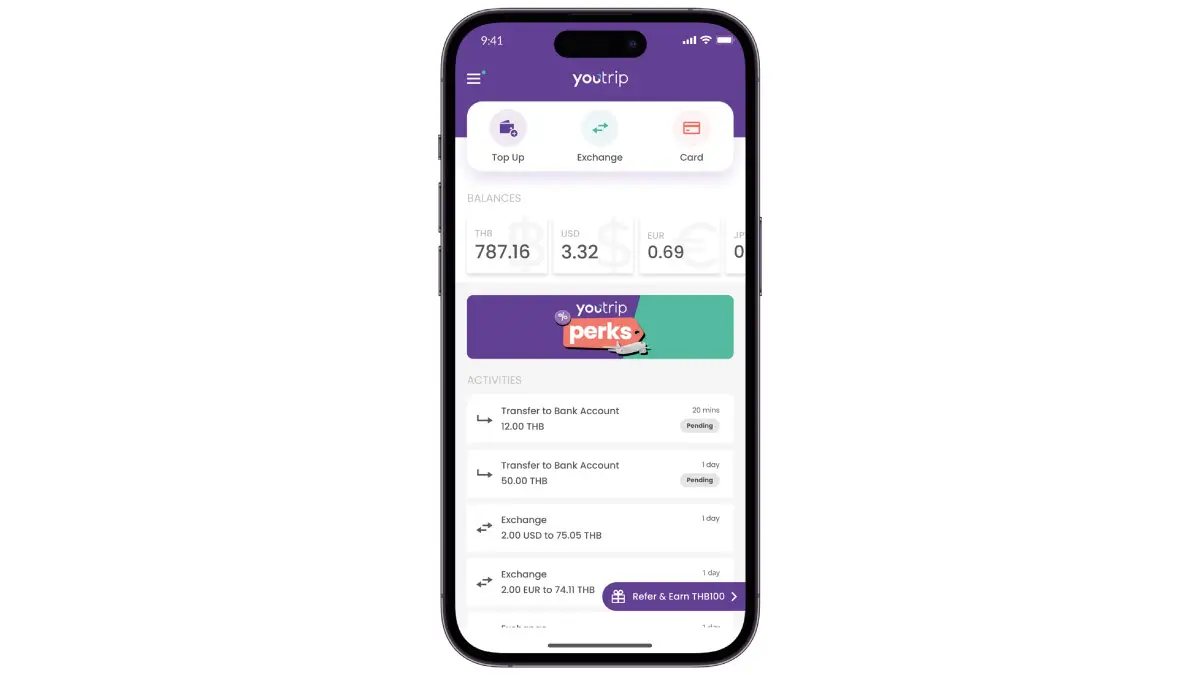

Supports Multiple Currencies: The card covers over 150 currencies, meaning you can shop practically anywhere hassle-free.

Purchasing tech internationally can be financially rewarding but only if exchange rates and fees are optimized. Here's precisely how YouTrip helps you save:

Check the YouTrip App for Current Exchange Rates: Open the YouTrip app and instantly see today's competitive exchange rates.

Load Money at Favorable Rates: Instantly top up your YouTrip card from your local bank account in your preferred currency.

Use Your YouTrip Card Online or In-Store: Complete transactions with confidence knowing exactly what you pay, without hidden fees.

YouTrip bypasses traditional banking channels, directly accessing wholesale exchange rates. This reduces the markup banks typically apply.

Purchasing expensive electronics internationally raises legitimate security concerns. YouTrip has robust security measures designed specifically to protect tech-savvy users on-the-go.

Instant Lock and Unlock: Immediately freeze your card via the app if lost or stolen.

Real-Time Notifications: Receive immediate updates for every transaction, ensuring peace of mind.

Virtual Card Option: Use a virtual card number for online transactions, significantly reducing exposure to fraud.

Activate notifications in-app.

Enable virtual card for online purchases.

Immediately lock card through the app if suspicious activity arises.

These proactive measures minimize risks and prevent unauthorized spending, vital when investing in high-priced tech gadgets overseas.

To fully grasp the advantages of YouTrip, let’s directly compare it to traditional credit cards.

This direct comparison clearly illustrates why YouTrip is superior for tech purchases abroad, simplifying choice and clarity for travelers.

To validate our claims, here’s what real tech enthusiasts say:

The SG Nomad, Travel Influencer: "Can’t imagine traveling without YouTrip! No more fumbling with cash or worrying about exchange rates, just tap, pay, and enjoy the adventure. Makes every trip so much smoother!"

Woan Ying, Travel Lover: "YouTrip is a must-have for travel! No worrying about carrying enough cash — I can shop, dine, and explore hassle-free with great rates and no hidden fees! Traveling made easy."

Sources : https://www.you.co/sg/ytfam-youtrip-creators/

When buying tech abroad, smart consumers need tools that prioritize transparency, security, and convenience. YouTrip not only excels in these aspects but actively empowers users, removing barriers previously associated with international spending.

Tech-savvy travelers appreciate solutions that are both straightforward and financially beneficial. With YouTrip, the anxiety associated with hidden fees, unfavorable currency exchanges, and fraud is virtually eliminated.

Enjoyed this comprehensive review? Follow our FaceBook page, Linkedin profile or Instagram account for more expert insights and practical tips on cutting-edge technology.

Special Offer:

Sign up using a YouTrip referral link and both you and your referrer will receive S$5 after your first top-up. (YouTrip's official referral program rewards both parties with S$5 each.)

Make sure you use the referral link provided to register and top up your new YouTrip card to qualify!

For personalized consultation or expert advice on tech purchases and international travel gadgets, contact the friendly specialists at Esmond Service Centre. We're here to make your tech journey seamless!

Reviewed and originally published by Esmond Service Centre on June 11, 2025

Mon to Fri : 10:00am - 7:00pm

Sat : 10:00am - 3:00pm

Closed on Sunday and PH